People in the United States are increasingly accepting of pastors endorsing political candidates, according to a recent report by Lifeway Research. The report indicates that “the percentage of Americans who see pastors endorsing a candidate in church as appropriate has risen steadily over the past 16 years.”

In detail, Lifeway found that only 13% of respondents in 2008 considered it appropriate for pastors to endorse candidates in church. This figure has risen to 29% this year, with 44% of respondents aged 18-34 supporting the notion. Furthermore, when asked about pastors endorsing candidates “outside their church role,” 45% of respondents viewed this as appropriate, while 38% disagreed.

Support for churches publicly endorsing candidates for public office has also increased, rising from 22% in 2008 to 32% in the current year. However, despite this growing acceptance, 48% of respondents believed that churches endorsing political candidates should lose their tax-exempt status, while 31% disagreed and 21% were unsure.

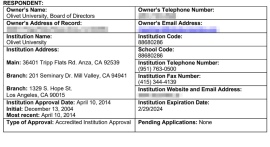

The data for this report was partially derived from an online survey of 1,200 Americans conducted from August 14 to August 30, maintaining a margin of error of plus or minus 3.3% at a 95% confidence level.

In recent years, the debate over whether the federal government should repeal the Johnson Amendment—a provision that prohibits tax-exempt nonprofits, including churches, from engaging in political campaigns—has intensified. In August, National Religious Broadcasters, Intercessors for America, and churches in Texas filed a complaint against the Internal Revenue Service (IRS), arguing that the Johnson Amendment discriminates against churches.

The lawsuit asserts, “Churches are placed in a unique and discriminatory status by the [Internal Revenue Code].” It continues, “The IRC places them automatically within the ambit of 501(c)(3) and thereby silences their speech, while providing no realistic alternative for operating in any other fashion.”

The Johnson Amendment has previously withstood legal challenges, including a case in 1999 when U.S. District Judge Paul L. Friedman upheld it against a church that had aired advertisements opposing then-President Bill Clinton.

The judge stated, "In the circumstances presented here—where a tax-exempt church bought an advertisement that stated its opposition to a particular candidate for public office, attributed the advertisement to the church, and solicited tax-deductible contributions for the advertisement—the IRS was justified in revoking the tax-exempt status of the church."

He added that “plaintiffs were offered a choice: they could engage in partisan political activity and forfeit their Section 501(c)(3) status or they could refrain from partisan political activity and retain their Section 501(c)(3) status. That choice is unconnected to plaintiffs' ability to freely exercise their religion. Plaintiffs therefore have not demonstrated that the IRS substantially burdened their free exercise of religion.”